Market

RARE WHISKY 101

RARE WHISKY 101

Weekly Insight by Andy Simpson – November 12, 2015

The challenge on Tuesday night (and early Wednesday morning if we’re being totally honest) was to wear this year’s Diageo Special releases…

Attack of the Special Releases

For next year’s challenge I apparently have to abseil down Drummuir Castle while nosing the samples!?!? Thanks must go to Eli Larson from Diageo for that gem, thanks very much pal!

Anyway, daft stuff aside (and there was plenty), we got to test-drive this years bottles at Drummuir Castle (Diageo’s impressive fortress of solitude… or maybe Greyskull others may pose?) in the heart of Speyside. There are plenty of other articles out there now about detailed liquid profiles, so we’re looking at reviewing them with collecting/investing in mind.

That said, it would be plain rude not to at least briefly mention the liquid – That is what it’s all about of course. So, in order of preference and scored out of 10, they’re listed below. The way we (granted very rarely) score is that 5 is in the middle, therefore that’s a perfectly drinkable malt. These bottles should not feel offended by being a 5, that’s a good enough score for a good enough whisky. Most of your decent common-or-garden house malts are in and around the 5 mark from our perspective. 1 is undrinkable and 10 is the best thing we’ve ever nosed/tasted.

Separately, I nosed a 22-year-old single sherry cask from Speyside Distillery on the way to the Diageo event… it got 1! It’s the first whisky this year to make me physically jerk my nose away from the glass… think molasses sweetened liquified rubber bands. Anyway; the legendary lowest score of 0.0 is solely reserved for Loch Dhu… it just has to be. Fact. Full-stop. The end.

That’s the liquid – Least best was the Pittyvaich, best best was the Clyne-hellishly-good. It’s all personal though, I know others who really liked the Caol Ila and weren’t so keen on the Clynelish.

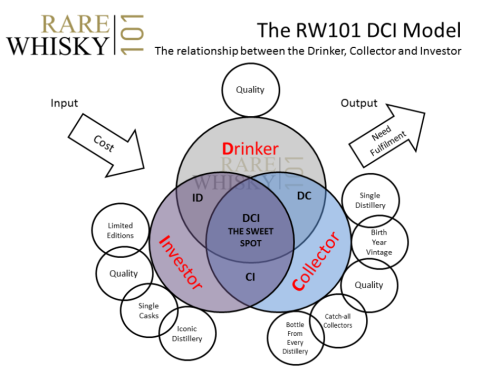

From a collector/investor perspective, we need to factor in some other variables. Some may be familiar with the Rare Whisky 101 DCI (Drink/Collect/Invest) model published in our 2014 annual review. This will evolve over time, but we’re going to start scoring bottles based upon those three criteria.

To explain – Take the Dalwhinnie 25-year-old – From a ‘D’ perspective, it’s already been given a 5 out of 10. The ‘C’ element is going to take into account its appeal to a broad collector base… is the distillery desirable, is the bottling limited, if so how limited, etc. We’ll award the Dalwhinnie a 3 out of 10 for that.

It is limited, it’s a mid-old-ager but it has limited appeal to collectors. Finally, the ‘I’ investor dynamic takes into account the most important investment principles – point of entry and point of exit. Is it expensive for what it is? If it is, it scores low, if not it scores higher. And does it have the potential to increase in value over time? The Dalwhinnie will score a 2 out of 10 here. Historically, Dalwhinnie has been a poor performer at auction with values frequently falling significantly lower than RRP’s. Our Dalwhinnie 25-year-old therefore scores a total of 10 out of 30 represented by (D:5/C:3/I:2). If you want to buy it, it’s a clear drinker, not one for a hold. Not really even a long-term hold as there are far better things out there from a collector/investor perspective for £250.

It’s a little ambiguous but then so it scoring a whisky on its flavours and aromas. What we’re trying to do is answer one of our most frequently asked questions of “what should I be collecting?”

£750 per bottle. 5,060 bottles.

I really think this will struggle to sell. The price is just too high for a single grain. The whole single grain category has failed to capture the collectors market. Drink it, fair enough if it’s your style but don’t expect this to do anything other than bomb from a secondary market perspective. If you want to spend £750 on a bottle of Scotch for investment, go buy 5 or 6 bottles of Rosebank at auction. Don’t give this a second glance unless you’re simply admiring the packaging… which is actually very cool.

£90 per bottle. Limited release.

Highland style Caol Ila has not fared well at auction to date. It does have a fan-base as a liquid; however, all but the rarest of Caol Ila bottles do little from an investor’s perspective. Low interest for collectors but good pricing will, to some degree, appeal to generalist bottle collectors.

£550 per bottle. 2,946 bottles.

VERY good liquid. VERY high price. NAS. Last years release has appeared at auction and sells for c£300 per bottle. Expect the same losses to be crystallised from this years. Take advantage of that, buy this at auction and just drink it. The limited nature of the bottle at less than 3,000 means it has some appeal to a collector but anyone wanting to tuck this away expecting future gains should be prepared to hand it to their grand-children in 50 years.

£250 per bottle. 5,922 bottles.

A relatively voluminous release but very keenly priced. The first rule of investing in whisky is that the whisky should be superb quality. That falls down here. That said, there is a certain appeal noting what you’re getting is a relatively old whisky from a silent distillery. At this price, that can’t be overlooked. There are utterly miserable bottles of Port Ellen out there from indie bottlers which still fetch the same market value as good-un’s.

£80 per bottle. Limited release.

Accessible pricing and high demand will see this suited to many Islay / Lagavulin collectors. Early releases of the 12-year-old cask strength are performing reasonably well at auction but a lengthy wait is required. Don’t expect instant gains but a solid bet at the price. There are many Lagavulin collectors who will ‘need’ this to maintain the completeness of a collection so expect demand to be strong.

£380 per bottle. 2,952 bottles.

Above average prospects for this relatively unknown brand. Attractive pricing and the high quality of liquid make it a compelling proposition to all three buyer-types. Depending what Diageo do with the brand moving forward will have an effect on values. £380 for ANY 34-year-old in this day is great value. One I’ll personally be buying to open and enjoy… If I can find one! It’s just one point short of pipping the Port Ellen but we actually see this as a stronger pure investment than the Port Ellen becasue the price is excellent for the quality and age of the liquid.

£2,400 per bottle. 2,964 bottles.

The last two years have seen these iconic bottles fail to sell out in their usual record time. £2,400 is a massive amount of money for a 70cl bottle of drink which is what it is when all’s said and done. To counter that, we’ve said it before, but the annual PE releases were vastly under-priced until recently. There needed to be an element of correction from a retail / primary market perspective. The rate of acceleration of those increases has been the main shock to the system. Still one of the most collected distilleries, but pricing has massively pared back these bottles as an investment. Are they going to be worth £5,000 in two or three or even 10 years? We think not but we’ve been wrong before. The key risk at this price is that many will be used to keep a complete collection complete, few will be buying two to drink one/keep one so supply won’t necessarily be taken out of the market.

£1,300 per bottle. 2,976 bottles.

Recent price increases (which were needed, it was far too cheap a few years ago) have prevented this being an outright 10 from a collector/investor perspective. But it’s Brora, stocks are thin on the ground, time is running out for the highland heavyweight collectable. Full set collectors will need this. From an investment perspective, don’t expect instant gains, the pricing has removed any likelihood of that. But, given time, we still see this as the pick of this years bottles. We could actually argue it’s still under-priced for what it is.

From a pricing perspective, there are bottles here which represent true value, there are bottles we think are particularly good value (the Brora, the Dailuaine and the Pittyvaich) and also bottles we see as poor value (mainly the Cally). We have to also take a view on the rest of the market. The recent release of 25-year-old Littlemill for £2,000 moves the phrase ‘aggressively priced’ to ‘we actually don’t want to sell this to anyone with a modicum of common sense’. The price for the Littlemill is perceived as so immensely high that I’m hearing of retailers refusing to stock it. If customers pro-actively request a bottle then one can be sourced, but they won’t physically stock it or actively market it… when retailers show a new product the door, you know there’s a problem.

I absolutely must thank Diageo for their amazing hospitality on the evening, it would be utterly rude not to do so; it’s amazing to be able to try all the special releases in one fell swoop. However, this isn’t meant to advertise or promote these bottles, merely assist in answering a question we get asked many, many times.

Interestingly, the Dailuaine is the one to sell out in record time this year, it’s disappeared from a number of retailers already. The big guns are still on the shelves demonstrating the need for a careful balance of price, quality and age/NAS. I wonder how many bottles of Littlemill 25 have sold?

We’ll respect your privacy. Also, you can unsubscribe at any time.

We’ll respect your privacy and you can unsubscribe at any time.