Market

RARE WHISKY 101

RARE WHISKY 101

Rare Whisky Review by Andy Simpson – February 22, 2017

In our first rare whisky review of 2017, what we’re seeing is continuation.

That might sound a little dull… continuation suggests nothing’s changing, the status quo remains the same. To some degree that’s right, however, what we’re seeing in early 2017 is far from boring. Two things at this early stage of the year –

One – there looks to be little slowing in the increase in values for the right bottles.

Two – the number of fakes in the market is increasing.

Positive’s first.

Looking to Scotch Whisky Auctions, we saw a new record for the third release of Black Bowmore. £7,400 sealed the bidding at £400 ahead of Bonham’s previous December 2016 high. Looking back just under twelve months and the price was £5,150. Take it back to February 2014 and the price for this bottle was £3,500. Amazingly in 2008, these were selling for £1,400.

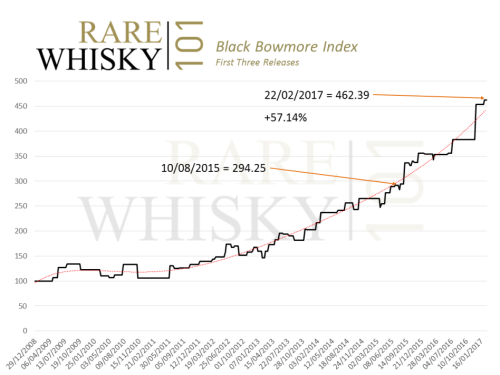

This buoyancy provided ample opportunity to re-run the Black Bowmore Index which we last published in August 2015; some eighteen months ago when the index stood at 294.25. That was impressive enough, however, we’ve seen a further 57.14% increase since then, with the index now standing at 462.39.

From a monetary perspective, the £ cost of the three first releases of Black Bowmore at the start of the index in 2008 was £4,520. That cost has now risen to £20,900. Last years release of the 50-year-old Black Bowmore completes an impressive five-bottle set. Values should remain buoyant for these in-demand rarities. Noting there can only ever be a maximum of 159 full sets of five bottles (159 bottles of the 50 were released), expect fireworks if all five ever make it to auction as a collection. The fourth Black Bowmore also set two record sales in February; Just-Whisky pipped Whisky-Online Auctions by a fractional £25 to take the highest price paid to £10,125.

Not wanting to leave White and Gold Bowmore’s out, Whisky-Online Auctions sold a bottle of each earlier this month for an equal £6,100 per bottle – both new record prices.

Clear some shelf space!

Assuming the full £16,000 retail price is paid for a 50-year-old Black Bowmore, all seven bottles of the-colours-of-Bowmore collection would cost £59,225. Bargain!!?

Another high value set/collection taking recent glory is Macallan’s Lalique decanter set. The sixth and final pillar, or decanter, was released last year. So, as with Black Bowmore, this particular collection of Macallan in Lalique is now consigned to history. For completeness, the list of the six pillars in Lalique are –

Not content with selling the most expensive bottle of whisky sold at a UK auction last year, London-based Whisky.Auction now hold the title for selling the most expensive bottle of Macallan sold at auction in the UK. £41,000 was the magic number required to secure a second release Lalique decanter. Having been up close and personal to a few of these in my time, I might suggest that the postage would possibly cost as much as the bottle!

It’ll be fascinating to see what the full set of Lalique’s (pictured below) sell for on the 2nd of April at Sotheby’s in Hong Kong. The set (in a Lalique made cabinet with some F&R mini’s for good luck) is the only one in the world released by the distillery, so with enough avid (should that be rabid!) Macallan collectors out there, I don’t think the HK$2,000,000 – HK$4,000,000 (£207k – £414k) estimate will be too much of a challenge. In fact, I’d be very surprised if the upper estimate isn’t burst by a significant margin.

My drinks cupboard looks nothing like this… nope, nothing at all… Sadly!

Bowmore and Macallan had great months, but elsewhere some exceptional bottles sold for correspondingly exceptional prices –

Recently, Springbank seem to be getting the attention they rightly deserve for rarer examples. A long discontinued bottle of 12-year-old 100 proof managed a phenomenal £1,300 at Scotch Whisky Auctions – exactly ten times the £130 price-tag it was selling for in 2008.

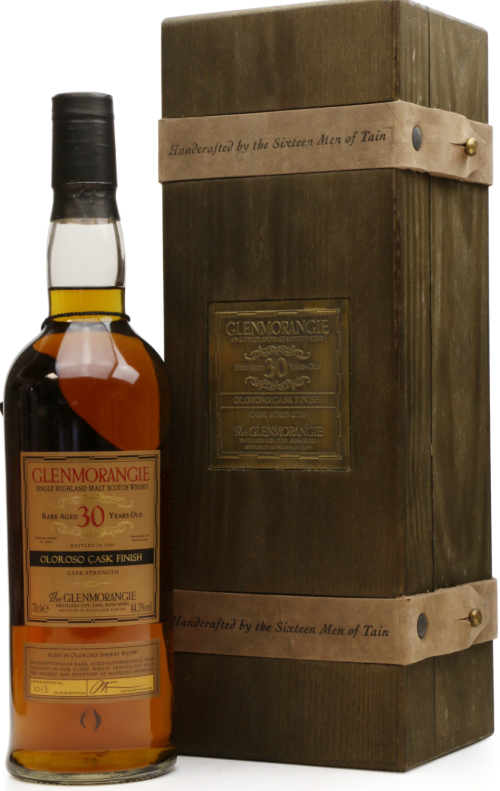

Just-Whisky took a bottle of Glenmorangie 30-year-old Oloroso through £1,000 for the first time when one sold for £1,030. As recently as June 2012 these could still be picked up at auction for sub £200.

Breaking £1000 for the first time.

Moving onto the second issue, we’re still seeing an increase in fakes on the market. Our view is still very clear on this, as values remain so buoyant, we will see an increase in the number of fakes.

We were speaking to fellow fake-haters, Scotch Whisky Auctions, today as some fakes had slipped through their (very tight to be fair) fake-net. The two blue label Macallan 30’s were a point of discussion as one was 100% fake, the other we’re 99% sure is fake (that’s sometimes the issue with imagery, we’d need to see the bottle to be 100% sure).

Challenges ahead for the market as fakes increase.

There was also a really good (by that I mean hard to spot) fake Macallan 1979 Gran Reserva as well. Between the blue label 30 and the Gran Reserva’s (we’ve seen ALL vintages of these faked) these are among the most faked, high risk bottles out there… and they’re not cheap so we’re not expecting this flow of fakes to be stemmed anytime soon.

It’s great to see that Scotch Whisky Auctions are taking an even tougher stance on fakes and are now barring sellers who are repeat and deliberate offenders. Clearly Scotch Whisky Auctions have done/are doing the right thing for their buyers too by refunding payments and taking bottles back.

The interesting thing is that all these bottles sold for their current market value, so there’s a real education piece required to help buyers understand how to spot these things. But there-in lies the conundrum – if everyone knows how to spot fakes, fakers will correct these errors and get better.

That said, we’ll be doing a lot more on this with many others later in the year. More on that later.

In summary, fakes aside, the start to 2017 looks positive. We’re certainly not expecting a mirror image of the gains seen in 2016 but demand still seems to be vastly more than supply can provide for. Early days yet and there’s still plenty of time for the arrows to start pointing down but we’re not seeing significant stress in the market for now. Cautious optimism is the phrase of the month here.

Slainte,

Andy and David.

We’ll respect your privacy. Also, you can unsubscribe at any time.

We’ll respect your privacy and you can unsubscribe at any time.