Market

RARE WHISKY 101

RARE WHISKY 101

Weekly Auction Watch by Andy Simpson – December 7, 2015

Price is whatever anyone wants to ask for a ‘thing’. An asking price can be as wholly realistic or as flamboyantly outlandish as the seller of that particular thing decides. If the price is right, the thing sells – if the price is low, the thing sells fast – but if the price is too high, the poor thing sits on a shelf gathering dust. Value, on the other hand, is what the thing is actually worth.

That’s part of the beauty of the secondary (auction) market; it highlights true value and provides an open market test of worth.

Take, for instance, the relatively recent release of the revised Mortlach range. A controversial 50cl bottle size and ambitious pricing raised eyebrows. The 25 year old range topper costs £600 per bottle, or £840 per 70cl equivalent. For a new-start luxury malt brand to position itself above the combined prowess of the mighty Macallan (£680 per 70cl 25 yr old) and Dalmore (£600 per 70cl 25 yr old) takes some confidence.

It was interesting to see where the open market priced the Mortlach in the recent Whisky Auctioneer sale. Its retail price might be viewed as a little ‘toppy’, so how does its true open market value compare to the 25 year old Macallan and Dalmore?

From a sellers perspective, that places the Mortlach 25 into a very rare group of bottles indeed. Those who lose >50% in value when switched from the primary to the secondary market. We highlighted a recent Glenturret which saw a massive loss too, the Mortlach is almost on the same level. Taking into account sellers fees and VAT yields a 59.7% primary-to-secondary market loss. Not one for the collector/investors. That said, we do still see older OB and IB Mortlach performing exceptionally well. A trend we expect to continue if not accelerate.

Loss making primary market bottles aside; the recent Whisky Auctioneer sale would be best described as a continuation of a (mainly) very positive theme. In many cases demand for the usual suspects took to new highs while other bottles continued to fall.

Rapid increases in value for Port Ellen OB’s

The Port Ellen official releases performed amazingly well with new records for the 5th, 6th and 8th releases. £950, £1,150 and £945 (respectively) took these bottles soaring past respective low values of £150, £140 and £170 in 2009. While average Indie per-bottle prices are still some way under the OB’s, massive demand took many IB’s to new heights. Both the Signatory port wood finishes hit new records with the first edition hitting £480 (£90 low point in 2008) and the second edition taking £575 (£80 low point in 2008).

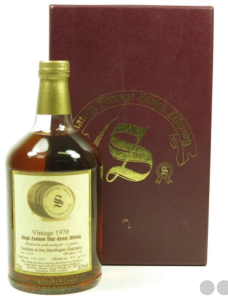

Bottles from silent siblings Millburn and Glen Flagler also fetched impressive numbers. A Douglas Laing bottled 1969 36 year old Millburn achieved £425 and a 1974 31 year old from Cadenheads took £345. Signatory’s 1970 23 year old Glen Flagler made £600, up from a previous £420 best.

Continuing a different theme; Karuizawa values softened further. Good examples of this swift descent from previous peaks as high as Mount Asama itself were –

Again, taken from their original retail prices, these sale values are far from catastrophic; however, bottles purchased at auction earlier this year look like losses will be further extended.

Our final distillery this week is Glenfarclas. Producers of some of the best spirit on earth; ‘probably Speysides finest’ as they have been known (who the hell am I to disagree to be fair) look like a long due upshift in values is on the cards. More recent contemporary releases are remaining relatively stable, however, values for older vintages are hardening. A bottle of Signatory bottled 40 year old from 1958 achieved £1,260 up significantly on its 2014 high of £800. A bottle of the OB 1959 vintage fetched £850, again, a significant uplift on its previous £600 record.

Are Glenfarclas values set to increase?

Compare values for similar old vintages from other well-known distilleries and it’s not difficult to see why interest is now shifting to Glenfarclas. Prices in the current market look very favourable from a quality and age perspective.

December promises the highest ever number of bottles to hit the open market. As widely discussed, the end of 2014 had a supply led slowdown in values. Right now, this year looks to be bucking the trend.

In what is set to be the biggest whisky auctioneering month on record, can demand continue to outpace supply?

Until next time.

Slainte,

Andy

All images courtesy of Whisky Auctioneer

We’ll respect your privacy. Also, you can unsubscribe at any time.

We’ll respect your privacy and you can unsubscribe at any time.